r - GARCH(1,1) volatility forecast looks biased, it is consistently higher than Parkinson's HL vol - Cross Validated

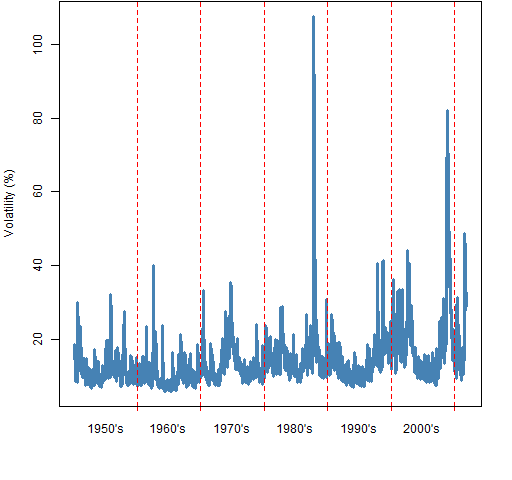

A practical introduction to garch modeling | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

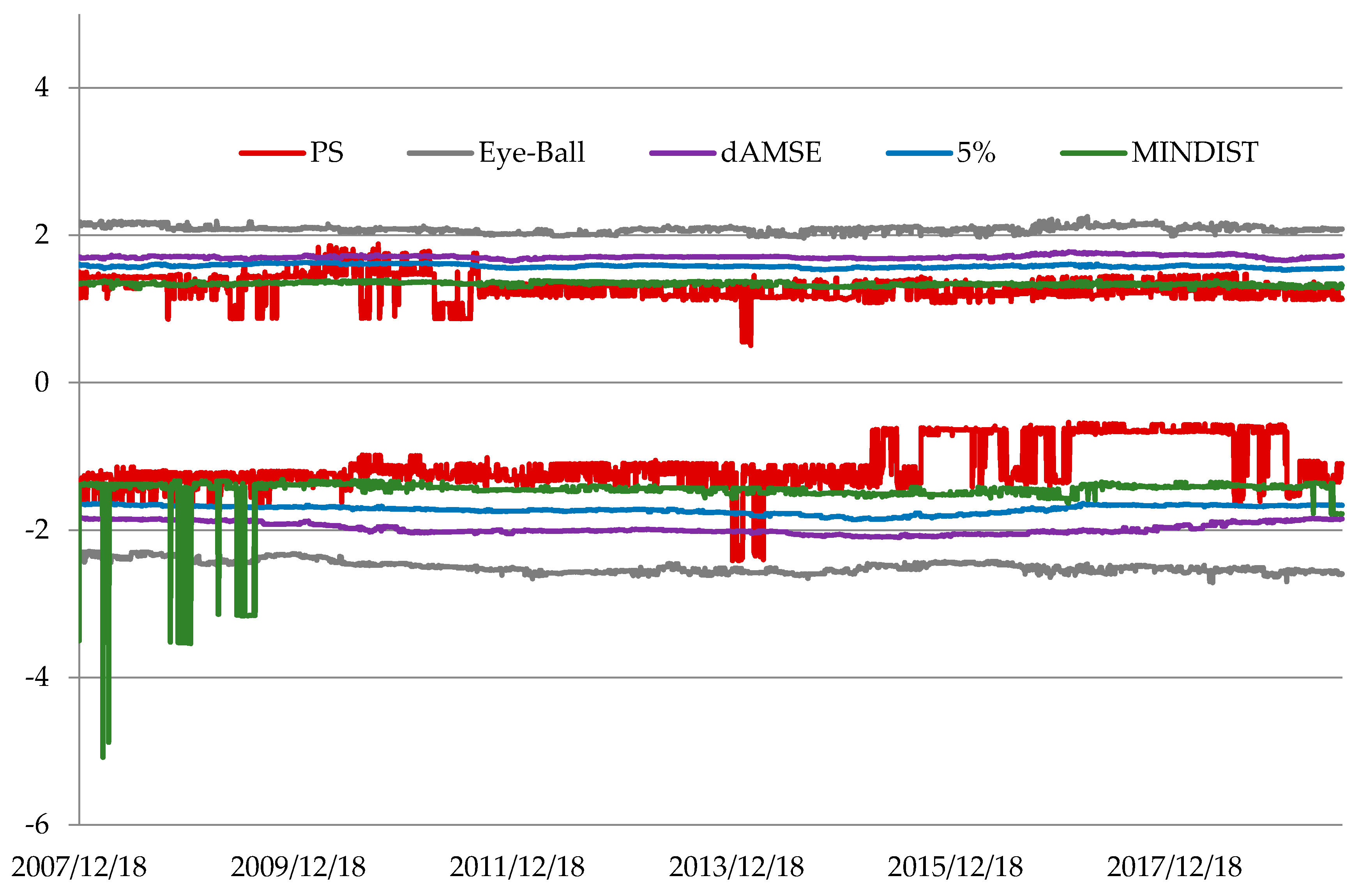

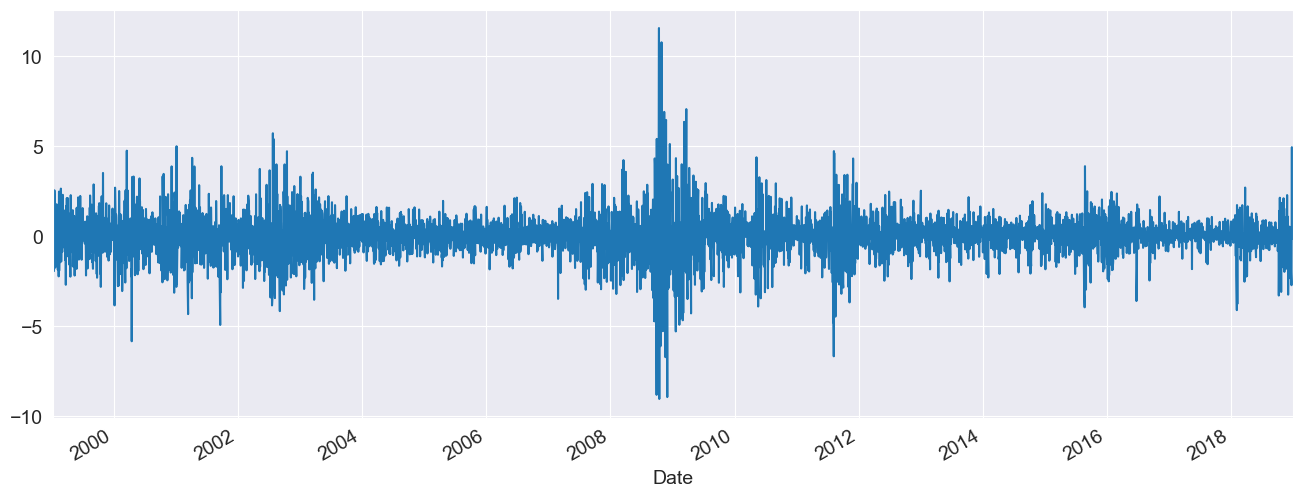

Mathematics | Free Full-Text | Value at Risk Estimation Using the GARCH-EVT Approach with Optimal Tail Selection

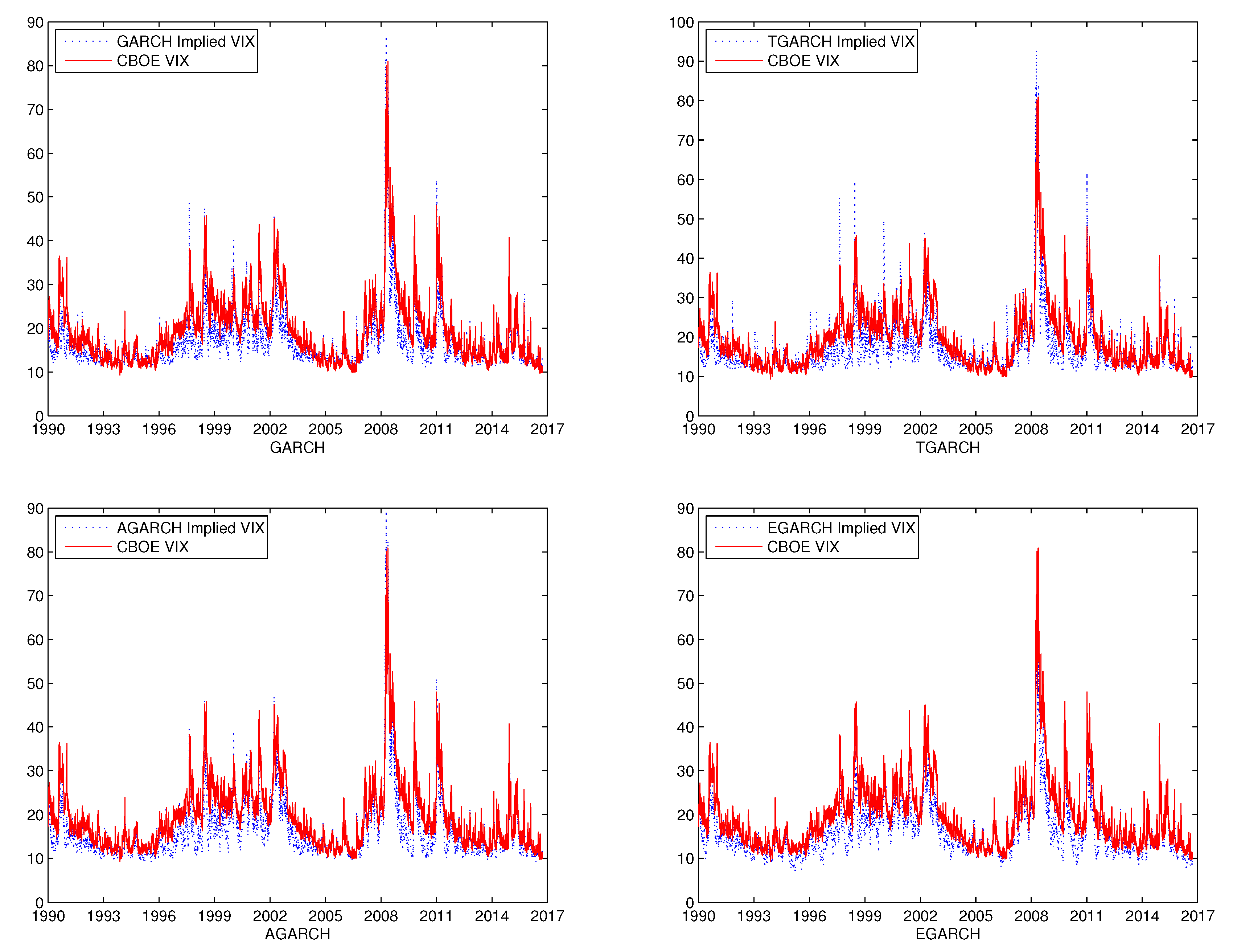

Closed-form variance swap prices under general affine GARCH models and their continuous-time limits | Annals of Operations Research

Comparison of the price surfaces of TVOs obtained from semi-closed-form... | Download Scientific Diagram

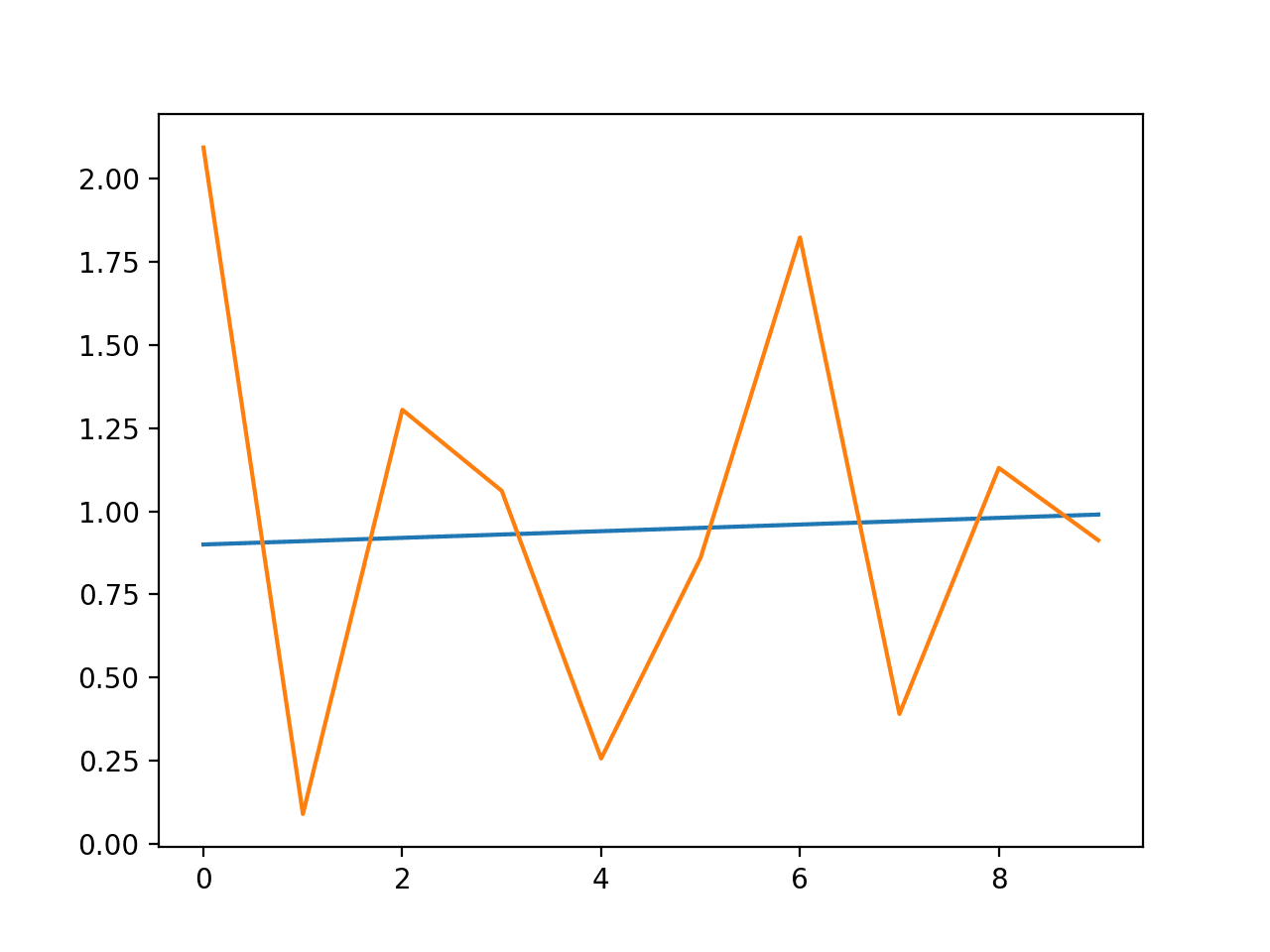

How to Model Volatility with ARCH and GARCH for Time Series Forecasting in Python - MachineLearningMastery.com

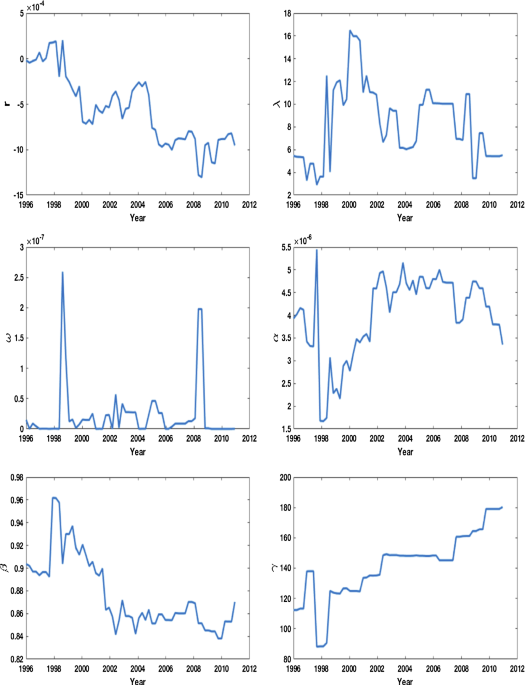

![PDF] On the Nonlinear Estimation of GARCH Models Using an Extended Kalman Filter | Semantic Scholar PDF] On the Nonlinear Estimation of GARCH Models Using an Extended Kalman Filter | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/dbae8b2113dec55a4a70cd46b10fbd0f3ec670b5/4-Figure3-1.png)

![PDF] On the Nonlinear Estimation of GARCH Models Using an Extended Kalman Filter | Semantic Scholar PDF] On the Nonlinear Estimation of GARCH Models Using an Extended Kalman Filter | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/dbae8b2113dec55a4a70cd46b10fbd0f3ec670b5/3-Figure1-1.png)